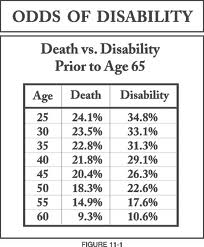

Last time we talked about the three pillars of protection for you and your family: Disability, Life and Health insurance, with our primary focus on disability insurance. This time we will cover life insurance protection. If someone is depending on you, whether you work outside of the home or you are a home-maker, it is important to have adequate coverage. No one knows when they are going to go and that is why it is so important to protect yourself against the unexpected.

Last time we talked about the three pillars of protection for you and your family: Disability, Life and Health insurance, with our primary focus on disability insurance. This time we will cover life insurance protection. If someone is depending on you, whether you work outside of the home or you are a home-maker, it is important to have adequate coverage. No one knows when they are going to go and that is why it is so important to protect yourself against the unexpected.

If you are a single mom who is raising children on your own, it vital that you protect your children’s future. Getting life insurance could be the most important thing that you could ever do for your children. If something were to happen to you, who would provide for your children? Would it be your ex-husband, your parents, a nanny, etc.? In either case, money will be required. Don’t assume that someone will step up to the plate to provide for your kids when you die. It would be a shame for your children to struggle and you could have provided it!

A common question that is, how much coverage should I have? The minimum recommended amount is six times your annual salary. So if you make $50,000 per year before taxes, you would need $300,000 at MINIMUM. If you have a lot of debt (cars, homes, credit cards, etc.) your coverage amount could be as high as twenty times your annual income. This is a decision that you will have to make for yourself, but whatever you decide, make sure that the premium is an amount that will be sustainable for future payments. Your life insurance is not something that you want to cut corners with.

There are two main types of life insurance: term and permanent. Term Life Insurance is when you make payments to a life insurance company for a certain amount of time, say ten years. Keep in mind that you will be protect only for that amount of time. One of the advantages of this type of policy is it is very cheap and generally easy to get. Permanent Life Insurance protects you for your entire life, as long as you make your payments. It is known by several different names: whole life, final expense, burial, universal life and variable life. It can be a little more expensive than term life simply because once you get it, it’s yours for life.

I am really passionate about people having life insurance and knowing the amount of coverage the policy provides. Here’s why, when I was growing up I remember he “insurance man” coming by my grandparents’ house to collect their premium for their policy. My family thought that my grandmother’s policy would more than cover her final expenses once she passed. My grandmother passed away from a heart attack many years later. Imagine our surprise when we found out that her policy was worth only $500! It is always worth the time and effort of founding out the worth of your policy, if it’s still in effect and who the beneficiaries are. A good insurance professional will check with his or her clients at least once a year to see if any life changes have taken place in their lives.

If you don’t have an agent to help you with your needs, my firm would be available to provide you the services that you need. Simply drop us an email: contact@totalbenefitsllc.com or give us a call: 205-378-9352.