The importance of auto, health, homeowners and life insurance is well known. But disability coverage, which replaces lost earnings if you can’t work, tends to be ignored — until you need it.

The importance of auto, health, homeowners and life insurance is well known. But disability coverage, which replaces lost earnings if you can’t work, tends to be ignored — until you need it.

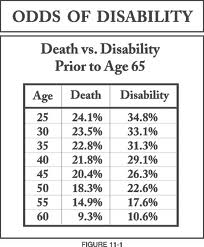

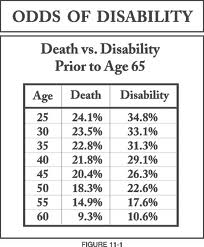

Government studies show that a 20-year-old worker has a 30 percent chance of becoming disabled before reaching full retirement age. Yet only about a third of employees in private industry have long-term disability insurance, according to the Bureau of Labor Statistics.

“It could be argued that the disability of a breadwinner is worse than the death of a breadwinner,” says James Hunt, insurance actuary for the Consumer Federation of America, “because the disabled person is still soaking up money.”

That’s why it makes sense to purchase individual coverage if you’re self-employed — or not covered sufficiently or at all by your employer.

A look at what you need to know about disability insurance:

Q: How does disability insurance work?

A: Disability insurance protects from a loss of income resulting from an inability to work due to an accident or illness. You typically receive disability checks starting three to six months after you become unable to work.

There are three sources of this coverage: The Social Security Administration, employers and private insurers.

— Social Security Disability Insurance is the bedrock protection against disability. About 153 million workers are insured by the program through FICA taxes. But it has a very strict definition of disability and it can take two years or more to be approved for benefits.

— Many employers offer disability coverage through a group plan, which pays a specified portion of your salary.

— Private insurance coverage is most often sought out by high-income professionals such as doctors and lawyers who have made a huge investment in their earnings potential; self-employed workers, and executives looking for supplemental coverage.

Q: Do you need to buy coverage if you receive disability insurance through your employer?

A: It depends whether you could get by on the benefit checks. A typical group plan replaces just 40 percent to 60 percent of your salary, up to a maximum $5,000 a month or $60,000 a year. And if the employer pays your premiums, the checks will be taxable.

Benefits can last for either a set number of years or until retirement age. Check your plan’s details closely. Company benefits have been steadily shrinking in recent years. Group policies often limit the duration of benefits to only two years if you can’t perform your job duties.

If your policy looks insufficient, ask your employer whether you can pay for additional coverage. Otherwise, consider getting extra insurance from a private insurer to extend the duration or bring the coverage up to 70 percent or 80 percent of income.

Q: Why can’t you count on Social Security Disability Insurance to cover your needs if you are disabled?

A: The average disability benefit is just $1,111 a month, based on payments by the Social Security Administration this month to 8.8 million beneficiaries. And you only qualify for it if you are unable to work in any capacity, not just at your chosen occupation. A list of conditions that are considered disabling is available by doing a search for “disability evaluation” at the agency’s website, http://www.ssa.gov .

Q: What should you look for in a policy?

A: If you have a highly specialized job or can simply afford to pay the premiums, it’s worth paying extra to have an “own occupation” policy. This coverage pays benefits if you are unable to perform the major duties of your own occupation. To trim some of the costs, it may be advisable to obtain “own occupation” coverage for one or two years and “any occupation” coverage after that.

The length of benefits is key, and will affect the cost of premiums significantly. Some policies pay benefits until age 65 or until your full retirement age for Social Security benefits, others for two or five years. Seek out a non-cancellable policy.

You probably also want a policy that will pay “residual” benefits, which will compensate for a decline in income if you are able to work at a new job that pays less.

Q: How much does disability insurance cost?

A: Prices vary based on age, gender, occupation, amount of coverage and health status. Check with a broker to get quotes from at least three different insurers.

For someone who does not have coverage at work, a plan with all the extras including inflation protection costs roughly 2 percent to 2.5 percent of annual salary for a man, and 3 percent to 4 percent for a woman. Women pay more because they file claims more frequently and for a longer duration than men.

If someone has coverage at work but wants earnings to boost benefits to 80 percent salary replacement, the annual cost is typically about 1 percent of the worker’s salary.

~ via Business Week

Tags: accident, bread-winner, budgeting, disability, Employee Benefits, employee financial educcation, illness, jjconsults, long-term disability, long-term planning, nest egg, personal finance, protection, short-term disability, wellness, women, workers

Once a woman takes control of her finances, she will never be powerless again. The growing power of women and finances is not some fly by night fad. It is the new normal in American households. 73% of households in the US are managed by single moms or women who are the primary breadwinner of the family and because of this fact; women need to have a handle on how to become more money savvy.

Once a woman takes control of her finances, she will never be powerless again. The growing power of women and finances is not some fly by night fad. It is the new normal in American households. 73% of households in the US are managed by single moms or women who are the primary breadwinner of the family and because of this fact; women need to have a handle on how to become more money savvy.